My Tesla investment thesis ‘open sourced’

As you have probably noticed, I’m a big believer in Tesla. Also, I think there’s a need to become more sustainable, and electrification of transportation and energy storage are part of the equation to achieve this.

I’ve also put my money where my mouth is and invested in Tesla. My goal is to invest with a conscience but also to make money in the process. This means I invest in companies that I believe in, that do something that matters and that operate based on values that I can subscribe to. This rules out investing in companies such as Facebook and many others, for various reasons. I also try to be open-minded and curious.

I’m hereby open sourcing my investment thesis of why I’m long Tesla amidst a 20% short interest in the Tesla stock. I’m curious about where you think I may perceive things differently than others, so I invite you to reply below.

Disclaimer: Even though I’ve learned a lot about Tesla, WHATEVER I WRITE HERE DOES NOT CONSTITUTE PROFESSIONAL INVESTMENT ADVICE. Your investment decisions are your own responsibility. Also: my investment decision has a non-rational dimension as well as rational dimension.

With my reasons to invest in Tesla I could start with vehicle energy efficiency and autonomous technology, but those are not the root causes of Tesla’s success as a challenger in the industry (even though these constitute a significant lead over the automotive competition). More important is the ability to create such a lead in such an industry the first place and the ability to capitalize on this lead by rapidly scaling up and create a sustainable competitive advantage (also called “a moat”).

Tesla is a one-of-a-kind company. Its similarities with Apple, Amazon and Ultimaker (the company I co-founded), however, are quite striking. While you should never base investment decisions on a simple comparison with companies that in retrospect were highly successful, it can be a useful “screening” filter to not invest in companies that lack key ingredients of winners.

Tesla: Leading the disruption in multiple industries

Below I will elaborate on characteristics of successful disruptors that I deem to be crucial:

- Having a mission that has relevance in today’s world

- Ability to attract talent and a culture where people excel

- A brand so strong that customers become ambassadors

- Products/services so good that they lead in every category

- Timing: operates in a market that’s ripe for disruption

A relevant mission

Key contributing factors start at the level of the mission and the culture of a company. Steve Jobs’ idea that Apple computers should be a bicycle for your mind are product focussed, and the same level of dedication you can find when you experience a Tesla product. Apple also stands out when it comes to upholding important values (in Apple’s case, privacy). For Tesla the mission of advancing the advent of sustainable energy is rooted in fundamentally humane values. The same values underpin Elon Musks SpaceX, Boring Company, Neuralink and ‘open sourcing’ the Hyperloop whitepaper (and at some point OpenAI).

Amazon is know for its rigorous focus on customer value and frugality and has kept marching on with the same mission, investing billions and billions. Tesla could have been profitable as a niche player already, either by making the safest production cars ever tested or by staying with the luxury and clean appeal of the Model S and X. However going “all in” and introducing lower priced vehicles was a priority because of its mission. Maintaining an unusually high growth rate obviously requires the company to be efficient with capital, but the high cash burn has been the point of attack of bears. Similarly, Amazon was seen as an online book-store when it was actually aiming to become “the everything store” we now know it to be. It was also ridiculed for making large losses. Tesla is in a similar position with it cash-burn and people’s perception of Tesla as a car company instead of an energy technology company.

A culture where talent excels

Most other automotive components can be bought and skilful talent can be attracted. Tesla is ranked second in terms of popularity among engineering students after SpaceX. Besides being another one of Elon Musk’s fundamentally humane ventures, SpaceX is also one of the most valuable privately held companies, immediately after AirBnB. But while AirBnB disrupted the hospitality industry, Tesla is disrupting energy storage, automotive OEMs, car sales, car service, ride-hailing and insurance.

The biggest problem with most for-profit companies is that they become so successful for a certain reason, that they forget why they existed in the first place. The original mission is implicitly or explicitly being replaced with satisfying shareholders financial returns. As soon as the stock price becomes a target for the company, this invites short term thinking and (Goodheart’s law applies here). The paradox is that a company in which people see products, services and customers purely as a means-to-a-financial-end fails will fail to meet such financial goals. The opposite is a cliché for a reason. With employees focusing on making relevant products, services and being customer oriented, companies have the best shot at being financially sustainable. A big problem incumbent automakers tend to have is that employees tend to do what’s good for their career instead of what’s best for the product. Tesla’s employees appear to be much more product and mission driven.

A strong brand: customers become ambassadors

The way in which Tesla interacts with its community is quite unique, but the benefit are similar to the ones Apple enjoys. Tesla customers (myself included) become advocates for the brand. They do this authentically because they subscribe to the mission and are genuinely excited about the products they own and in general have good service experiences. This makes them even better positioned than anyone in marketing to convince others, because a lot of people by now know that marketing can be manipulative, companies tend to over-promise and underdeliver. People rather trust their peers than a company that wants their money, rightly so. I was lucky to experience a similar evangelism among the customers of Ultimaker, the company I co-founded. In the case of Tesla, it gets free advertising from its car owners/fans, from Youtube video’s of drag races where amateur Tesla drivers destroys supercar competition simply by flooring it, video’s going viral of Autopilot seeing accidents before they happen or Elon Musk trending on Twitter (both the good and the bad).

Leading products

Tesla is the brand most known for innovation of all US companies (Apple comes in 3rd place and Amazon 5th). Tesla, Apple and Ultimaker are both makers of vertically integrated hardware and software. You can’t create a good product by excelling at one of the two, a company has to be proficient at both. You have to be willing to look at the full stack of the technology and not outsourcing any of the key “layers”. Both Tesla and Apple create their own chips from scratch to create better performing systems that have a good energy efficiency. Amazon’s created the Kindle e-reader to improve its book buying, downloading and reading experience. These products are connected and also require infrastructure to be set up. Tesla has made substantial investments: having designed the real-world data collection frameworks, a simulation environment, sensor suite, navigation software and the entire infotainment system allows a them to deliver a superior self-driving system and releasing it before the competition does.

Challenging multiple industries

Amazon may have started with retail as its core, it was not afraid to expand into internet services (AWS), physical gadgets (Amazon Echo, Kindle, etc.), media and entertainment and most recently: satellite constellations for global high-speed internet (competing with SpaceX). Similarly, Apple went from personal computers, to phones and other mobile devices, iTunes and app stores. Tesla, started out with passenger cars, but today offers energy storage, solar power products and most recently: car insurance. It aims to offer ride hailing services by 2020 in some jurisdictions. While it plans to expand into the pickup market and offer a semi-truck, comparing it to traditional automakers will paint a very incomplete picture.

Before the introduction of the iPhone, most people used phones with lots of buttons to make calls. Now most buttons are gone and you can do vastly more. The smartphone is becoming almost an extension to the human body and the hub in an ecosystem of apps, music and other services. It redefined the phone.

Tesla is creating high-performing, efficient, elegant and connected cars in a market where legacy automakers are just creating the next model with a new look and a slightly bigger combustion engine. Tesla is updating its fleet of products over the air since 2011 just like we expect from our smartphones, but other automakers have trouble entering the 21st century, because incumbent’s competencies still mostly center around increasingly irrelevant skills.

Attitude is everything

Elon Musk and his attitude is also a big asset to the company. Shooting a Tesla Roadster into orbit on SpaceX’s Falcon Heavy instead of a milled piece of aluminium, isn’t just genius marketing stunt, it’s part of the culture where working excruciatingly hard to achieve the impossible is combined with having fun or creating something frivolous like ‘Fart mode‘ or adding a fun racing game to their cars and turning the steering wheel into a giant game controller (pun intended). One could say that it’s just ‘frivolous’, but being playful is exactly the trait that comes with someone who is still exploring and who is learning what the boundaries are. A child’s rigorous experimentation, also called ‘playing’ is actually hard work but it doesn’t feel like it to a child. For a child playing means it’s growing its capabilities, critical to survival in the long run. Unlearning is harder. It’s often children that can adjust to a new reality more easily than grown-ups especially if they think they already know how everything works. Leading by example isn’t just what a parent should do, any executive within a company should do this, most notably the CEO. In my opinion, the best example of leader is someone who leads by example and pursues a humanitarian goal, a goal greater than itself. And while Elon is by no means perfect, he is incredibly persistent and hard-working to create a better future.

A market ripe for disruption

The auto industry is facing major changes happening all at once:

- rapid cost decline of batteries for electric vehicles making them increasingly competitive with low efficiency combustion engines

- the increased importance of connectivity and services (defrosting your car when you get up in the morning, is not a gimmick but saves time and frustration, for instance)

- car sharing and autonomous vehicle technology create an opportunity by changing the dominant “ownership model” of passenger vehicles into a service model.

This means that the timing is right for Tesla to have achieved a technical lead and market dominance in the dynamic and growing electric vehicle segment.

In the following parts we’ll talk about:

- the physics of engines, emission regulation, battery technology and the market transition toward electric propulsion

- ride-hailing and Tesla’s autopilot technology

- Tesla going into insurance

- Tesla energy products

- Vertical integration and its implications

- Why Tesla is set up for continued growth

Part 1: About engines and emissions

This topic comes in four sections:

- Fundamental limits of efficiency of a combustion engine

- Power vs. efficiency trade-offs: “It’s not how big your engine is, it’s how efficiently you can use it.”

- The climate, diesel vs. petrol and emission rights

- Inertia of the corporate kind

- China embraces electric vehicles

1.1 Fundamental limits of efficiency of a combustion engine

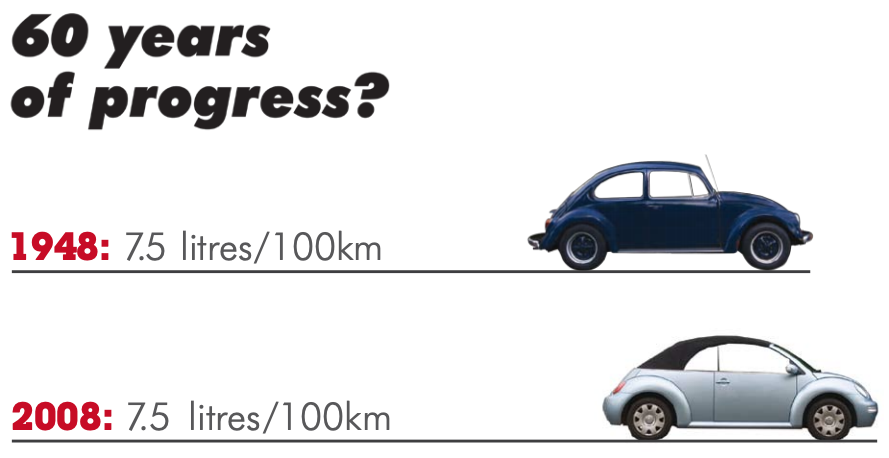

Because I reasoned from analogy in the previous section, I now start with first principe thinking, starting with facts we know to be true. While the automotive industry has invested over a trillion USD in the Internal Combustion Engine it has a major drawback that are known since 1824. In that year, Sadi Carnot established the fundamental limit on efficiency of conversion from heat to kinetic energy. A typical heat engine’s Carnot Cycle limits means that it wastes about half the input energy as heat. Combustion engines are heat engines of a particularly poor kind in terms of conversion efficiency governed by the Otto and Diesel cycles that limits the efficiency to around 46%. While things can be improved, even the latest Diesel technology under the most favorable conditions, still is below 35% efficient in real-world conditions. It’s clear that each percentage point you wish to improve this will cost incrementally more billion of dollars in investments and takes years before it’s in production vehicles. And if we’re really honest, cars have not improved much in efficiency for 60 years.

Automakers (OEMs) make its money from leasing, car parts and car sales (in that order). Dealers make the most money from parts & service. Once there’s an alternative that needs less parts replaced this is highly attractive for consumers, but a threat for carmakers that rely on ICE related revenue.

So let’s look at electric motors. The latest drivetrain efficiency reported by Tesla is 93% (which includes the losses of just 3% in the electric motor, but also power electronics, lubrication, cooling system, bearings and gears).

Battery EVs (BEVs) didn’t use be competitive compared to ICE vehicles most notably because of range. However, both the gravimetric and volumetric energy density of batteries as well as the costs per kWh improved dramatically over the years. Currently the cost of a Model 3 battery is roughly 37% of the vehicle, but vehicle cost parity between ICE and BEVs is expected within 5 years even with the current battery chemistry (Lithium Ion). For BEVs, the added cost of the batteries is more than offset by the energy and maintenance savings over the period of usage, and as long as resale value is high enough. Also, the lower energy density of the energy reservoir (battery instead of fuel tank) is more than offset by the combination of the following:

- replacing the combustion engine with an electric motor gives you a far superior power output with a 10-fold reduction of weight. Tesla’s AC-induction motor delivers 362 HP but weighs under 32 kg. a typical Diesel V8 engine delivers a peak power of 340 HP and weight 380 kg

- switching out the transmission to a small and simple fixed-gear speed reducer

- no starter, exhaust, smog controls, water pump, fuel pump, turbo’s, alternator, carburettor, etc. needed

For reference, for its latest battery architecture incorporating the 2170 cells (4,416 of them for 75 kW), the combined weight of the battery modules is just 478 kg. This same amount of weight is saved by switching out the engine and transmission with an electric drive chain. Also, weight isn’t as big a penalty as you might think, for efficient electric vehicles. Apart from some rolling resistance, the impact of weight is minimised by ‘regenerative braking’: unless you brake hard, slowing down happens by converting kinetic energy through the motor back into electrical energy stored in the battery (about 86% of the energy gets reused because 0.93*0.93*100=86%). Lifting your foot from the accelerator to slow down enables what is called “single pedal driving” and I can personally attest that it makes driving not just efficient, but also more pleasant and safer.

Most intellectual property of automakers centers around engine technology while most other parts are made by Bosch and Continental. Tesla has been going through a learning curve in a different field. It invested in its own manufacturing capacity of batteries (Gigafactory 1) for which it’s constantly improving the process technology in terms of CAPEX, OPEX (example), footprint and ecological effects (patent 1, 2) per unit of production (be it battery packs or vehicle). It also developed battery management software, denser battery packs, improved safety, improve thermal properties, longevity and shortened charge time all in an integrated way. For instance, optimizing cell chemistry for charging speed is most effective when combined with at least 5 other things: 1) developing high-power fast charging technology called “Superchargers”. 2) Permitting and installing Superchargers across the world. 3) designing the active-thermal management for optimal conditioning of cells 4) integrating the navigation software with the battery management software so you arrive at a supercharger with a pre-conditioned battery that is ready to take the highest charge rate and finally 5) usage and cell parameters from a large fleet of vehicles to use for designing the next iteration of all the former. 6) Navigation routes you seamlessly via Superchargers during trips. At a public V3 Supercharger, the Model 3 can currently charge at 1600 km/hour rate or add about 50% charge 246 km (153 miles) in 12 minutes. For long range travel, the inconvenience of charging is lower than getting gas, because you don’t need to wait for the fill up and can get refreshed as the car charges.

With Tesla’s acquisition of Maxwell Technologies Tesla has the potential to not just have influence of battery cell chemistry, they can design the manufacturing process of the cell and the cell specifically for their electric vehicle needs, from the ground up. While standardized, highly automated cell production has given Tesla the ability to reach Gigawatt output (which was key to making more than half a million Tesla’s), once you become one of the world biggest battery producers and consumers, it might be time to design a dedicated cell in conjunction with the accompanying manufacturing lines. I’m speculating, but it’s at least likely that parts of the electrode manufacturing will in the near future be done with technology from Maxwell. Also, Maxwell has a path to 500 Wh/kg and can provide a 300 Wh/kg density today. Tesla’s current cell density is believed to be at 250-260 Wh/kg, so once production capacity is added, we can expect a jump in range for Tesla vehicles. But Maxwell claims to be able to achieve more than the 15% energy density improvement. It also stated 16x production floorspace density improvement (for DBE electrode manufacturing), 10-20% cost savings and 200% longevity improvements are possible with its technology. A reduced reliance on Panasonic as a supplier of cell production technology is also a strategic benefit. There are exciting opportunities for hybrid batteries as well, e.g. those that combine metal-air with Li-ion (allowing heat reuse according to this Tesla patent) or Li-ion Maxwell’s Super- or Ultracapacitor technology. Metal-air batteries have a theoretical energy density much higher than Li-ion and minimal self-discharge, however Lithium-ion would be used for its high peak discharge rates.

1.2 The performance vs. efficiency trade-off

The reason why you rarely see a high mileage car that also has good performance is because the motor is either dimensioned for efficiency or for performance. Every ICE car has a strong trade-off between performance and efficiency. The bigger the engine the less efficient the car. Because electric motors can be quite compact and provide a lot of torque from 0 to high RPM, it’s so much easier to have performance and efficiency if you use an electric motor. It’s also easier to have one motor driving each axle, which enables 4 wheel drive without a driveshaft connecting front and back. Added benefit is that you can combine a motor that’s more efficient with one that has more performance. When accelerating hard you use both, when coasting, use only the efficient one. Also, they can be geared differently, so one is more efficient at high speed, the other at lower speeds. This has enabled Tesla to introduce All-Wheel-Drive with a better range, even though there’s small weight penalty to having multiple motors instead of a single, bigger motor.

Tesla’s new permanent magnet synchronous reluctance is more efficient, but the 3-phase induction motor has more power. Both are used in the All-Wheel-Drive variants of Model 3, S and X. The beauty is that with electric motors the power can be adjusted digitally at the millisecond scale and this enable much better traction. All this, and the fact that Tesla’s don’t need to switch gears, allows Tesla’s to constantly beat much more expensive ICE cars.

They also invested in better electric motor designs and drive electronics. Highly regarded industry veteran Sandy Munro who is famous for analyzing car technology says “Tesla’s motors are the lightest, most efficient, and most powerful”. In their technical deep dive Tesla compares very favourably to legacy automakers EV offering (recommended video). At launch, the range of the Model S was 265 miles (EPA rated). To date, no other carmaker has a car on the market that beats this Model S from 2012. For instance a Jaguar i-Pace’s or Audi e-tron that rolls off the assembly line still doesn’t have the range of the 2012 Model S, even if the latter was a used car driven over 20 000 km yearly for 7 years. Recently Tesla upgraded their flagship Model S and Model X with better electronics and a different motor. After the upgrade the Model S had 10% more range, leading to 595 km on the EPA cycle. Today now the entire lineup of production electric vehicles is dominated by Tesla.

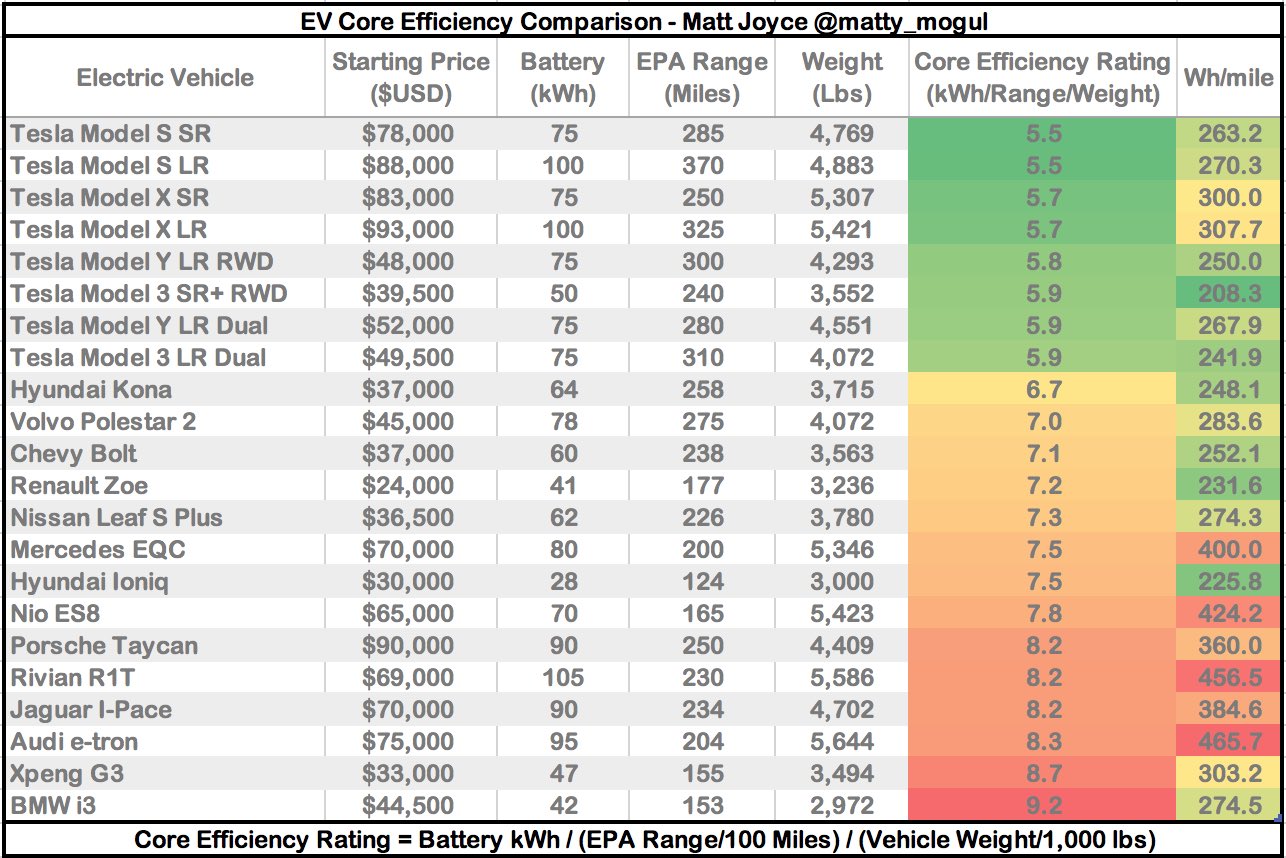

The Core efficiency chart by Matt Joyce

If a battery EV is less efficient and you want to supply the same range, that means you have to make up for it by adding a bigger battery. But the battery adds weight, which will reduce the range. The penalty of inefficiencies are magnified and end up creating a less competitive vehicle. People buying supposed “Tesla killers” like the iPace or e-tron will have a higher up-front cost, need to charge more often and longer and they don’t have access to the huge Tesla Supercharger Network that spans the US, Europe and China. “Tesla killers” have not taken any significant market share from Tesla, even though the “competition is coming, game over Tesla” rhetoric is repeated over and over. The auto OEMs that are forming alliances to build fast chargers are installing them at a similar rate, but that means they are not catching up either. Tesla’s are both compatible with Superchargers and the third party charging networks, so Tesla users will still have better infrastructure available to them in the unlikely event other get more charging infrastructure.

Besides efficiency and performance EV’s have significantly fewer moving parts and generally don’t wear out as quickly. This means that all the embodied energy (and cost) is spread out over a much longer lifecycle. The battery is arguably seeing the most “wear” (or degradation). Based on empirical evidence, on average the the degradation reduction stops at around 80% of the original battery capacity. This has to do with cell chemistry, battery management and coolant loop design and incentivising a healthy charging habits. The capacity fading is a key metric and it’s around 0,01% per full cycle. Even the batteries, the component that degrades the most, still will by far outlast even the most durable diesel engine. The beauty is that even if capacity for a vehicle becomes too limited, the batteries still have value as stationary storage before they need to be recycled (which already is both environmentally friendly and economically feasible today).

1.3 The climate, diesel vs. petrol and emission rights

Governments across the world are becoming increasingly strict about emissions. Most of this was announced well in advance, and most automotive companies had strategies to avoid the biggest fines. Some calculated in the fines.

What caught several of them off-guard is that the expected to be able to shift their sales mix to favor Diesel to meet emissions standards. If Dieselgate had not happened, this would have worked because Diesels are more efficient and emit less CO2 than gas cars that are base on the Otto cycle.

It caught most of the large automakers off-guard. In a KPMG survey among almost 1000 automotive executives, electrification was the 10th most important concern in 2014. It was at #9 in 2015 and in 2016 it was the 3rd most important thing. In 2017 electrification was the number one priority and in 2018 the 3rd most important. By 2018, Fuel-Cell technology had climbed to the top of the ranking, highlighting that auto execs are scrambling to meet tailpipe emissions standards.

1.4 Inertia of the corporate kind

All automotive companies except for Tesla rely on advertising in a fight for market share. This works if products differ mostly in superficial ways (e.g. taste). This works fine, as long as a market is growing and not facing disruption.

More radical innovation often comes from more nimble companies. But there’s more than technological innovation that can be radical, such as the business model of selling direct to consumer. It’s easier for a startup not to work with dealers, but to sell directly. Also, dealers are very reluctant to sell EVs because auto parts and service are about 5 times larger contributor to gross margins compared to the sale of a car. Dealers need to make more money on the sale, or they will see EVs mostly as a threat to their business. Tesla sells and services directly and uses only official Tesla parts in service. This means that they earn gross margins that no other carmaker is tapping into.

Over the air updates have become standard in smartphones, but the auto industry is reluctant to deliver it. 7 years after the release of the Model S which is always connected and gets improvements constantly, no other car manufacturer deploys its improvements in the way Tesla does it. I believe the Silicon Valley roots, compared to Detroit or German roots make it positioned to continue to lead in software, which is an increasingly significant part of a vehicle.

Tesla took initiative 7 years ago with its charging infrastructure but has yet to see another initiative catching up.

1.5 China embraces electric vehicles

China largest automotive market and producer in the world. 51% of global EV sales are in China. If it isn’t Tesla that’s going to disrupt legacy carmakers, it might be Chinese EV startups. Why, you might ask? So far, legacy OEMs are better at making large claims than making actual BEVs in large volume. The exceptions are the Renault-Nissan-Mitsubishi alliance and, notably, Chinese companies like BYD and BAIC. Just to illustrate: China as a whole spent $410 billion on R&D where Germany spends around $ 18 bln. China in 2017 registered 1.38 mln patents, almost twice as much as the USA in that year.

At a time when the German auto OEMs were investing in emissions cheating devices, the Chinese government is creating a breeding ground for about 100 car companies of which the majority is focused on electric vehicles. Entrepreneurs in the EV space are all but guaranteed to get funded. While it’s likely that many of these entrepreneurs will fail, some will be highly successful such as Geely that owns 100% of Volvo. Its founder, Li Shufu is the largest shareholder of Daimler (with 9,7% of shares).

When a country with such a large single market is encouraging electrification, it can build an industry. If the resulting EV industry from China is even half as successful as the photovoltaics industry (solar panels), it will have a major impact in automotive industry. China has a favorable climate for EVs (exempting 16 Tesla’s models of sales tax). Tesla is the only company to have a fully owned factory in China.

It’s not a question whether China will have a big impact on the development the industry, but it’s hard to predict how this wil play out.

Part 2: The ride hailing opportunity

Electrification is just one of the major areas of disruption of the automotive industry. The other big one is autonomy: self-driving vehicles.

For complex problems, Machine Learning has created a breakthrough by shifting the emphasis from a programming problem to a training and data labeling problem. The quality of the training data sets becomes the differentiating factor for the quality of the results. The Tesla fleet of over 600 000 Autopilot capable Tesla’s, many of them use Autopilot for a portion of their driving. At the end of 2018, Tesla had 1 billion autopilot miles under its belt. Of the self-driving competition, Waymo has the highest mileage after Tesla (2 400 000 miles in 2018). In June 2019 it’s estimated that Tesla collects data from the same amount of miles every day even if you count only the Tesla’s with AP2 or higher. This already huge lead will increase because the fleet of Tesla’s is growing so rapidly. To illustrate: in 2018 alone Tesla sold more cars than the 15 years before it. Many more billions of miles were driven by human drivers with the Autopilot system running in shadow mode, plus Tesla’s are driven in the US, Europe and China instead of just California, Arizona and Washington.

The robo-taxi opportunity alone is estimated to be a trillion dollar one and this upside doesn’t seem to be factored into the valuations that you see, or people assign a zero probability on Tesla capturing market share. Uber is currently valued at $ 75 billion and Lyft at $ 17 billion. Waymo at tens of billions of dollars. Their valuation is at least partially based on the promise of full autonomy. Based on the terms of service, however, no other company would be allowed to use Tesla’s as part of an autonomous fleet. Only Tesla will and this creates a moat around Tesla. The investments to get the first FSD computer hardware into production vehicles may have been very big, the marginal cost of more of them is quite low. One of the biggest advantages is that its power consumption is so low, it doesn’t impact mileage much so you can have it collect data and run in shadow mode. This leads to Tesla’s big advantage in autonomous driving: Tesla gets paid for Full Self Driving and people opt-in to send their valuable training data for free. Uber, Lyft and Waymo’s vehicles have much more expensive vehicles and safety driver are getting paid.

The subtlety of Machine Learning is that even though you need a lot of data, more of the same data doesn’t add any value. To be able to handle exceptional situations well, the data needs to include enough edge-cases that happen only very infrequently. While you need to have a lot of miles driven in a lot of places, you only need to harvest specific events from the fleet. Hundreds of thousands of Tesla’s have an advanced sensor suite (Autopilot hardware 2.5 or later) with sonar, radar and camera’s. This means that whether people have autopilot enabled or not, these vehicles have been collecting useful, specific data on edge-cases that Tesla can still learn from. Its fleet and already runs various features in so called ‘shadow mode’ and compares human driving behavior with what the algorithms would have done. When an important ‘delta’ exists between choices of drivers labeled as ‘good drivers’ and the algorithms, this is sent to the mothership and reviewed by a team that labels the data. That validated data is then used for training. If this allows Tesla to solve full autonomy on a larger scale sooner than the other ride-hailing companies it will have a significant competitive edge. Governments around the world are interested in having fewer traffic incidents, so if Tesla is allowed to show it’s significantly safer (in any jurisdiction, even if it’s an exemption somewhere) more and more jurisdictions will become convinced.

Before Tesla’s Autopilot version 2.0 hardware suite, it relied on MobileEye’s vision processor (the EyeQ3 chip) and a single camera. which was acquired by Intel for $ 15 Billion in 2017 by Intel.

NVIDIA is considered world-class in chip design and has repurposed its already-developed GPU cores for SAE level 2 advanced driver assistance systems (ADAS). Tesla has packaged these systems into their own Autopilot hardware, but they had to develop its own chip if they wanted to ship full self driving capable hardware in 2019 (SAE level 5). Nvidia’s Pegasus still isn’t available, would be too big, too power hungry and too expensive to package in the Model 3. Pegasus consumes 500 Watt instead of Tesla’s FSD at 70 Watt. After Pegasus, NVIDIA plans to release Orion. Tesla’s FSD computer is effectively an NVIDIA Orion-class product shipping today rather than in 2023. You would think that 430 Watts isn’t a big difference, but you get a penalty because cooling the electronics costs energy as well, and this isn’t even included. At low speeds, e.g. city driving, where most of the ride-hailing money is made, 500 Watts is close to 10% proportion of total power usage. This isn’t relevant for the competition between ordinary taxi’s and robotaxis, but in a scenario where Tesla’s FSD competes with another robotaxi player, with a price war between robotaxi fares, lower energy costs will enable Tesla to outcompete the others (all else being equal).

Today, most cars are idle about 23 of 24 hours. Once cars are shared and especially when they become autonomous, the utilization rate will go up because the closest available car can be summoned to your location. An advanced feature called smart summon is recently made available in the US. The car unparks itselfs to meet you on the other side of the parking lot (or a target position you choose). It has now been used 800,000 times. It gives Tesla a lot of data to learn how to automate driving in complex scenario’s while minimising the risks.

Even though Tesla is delivering value (and capturing revenue) earlier than anyone by launching partial Full Self Driving features one at a time, the end-game is full-automation. Tesla seems to be well equipped to develop this feature, and over time it can prove to regulators that the features are making driving safer than a human driver could be without automation.

When cars drive themselves, this could increase the use of shared cars. A transition from 100% car ownership to significant numbers of shared cars, means that car sales diminish, ceteris paribus. But combine this with longer-life and less maintenance needed for Electric Vehicles, the legacy automakers are about to have decades of difficulty ahead of it. Companies with connected, self-diving fleets that provide a web-browser, games, YouTube, Netflix and other streaming services will have an edge over other companies when mobility becomes an affordable service rather than an expensive purchase.

Part 3: Insurance

Tesla has started offering insurance in California in August 2019. At this point, it has the following synergies:

- Low acquisition friction because customers who order a Tesla are usually also looking for insurance and they basically only need to tick a box in an online form. With Tesla’s online direct sales model, it can undercut competition by leverage its existing IT infrastructure and they don’t need to advertise like other insurance companies do.

- It offers “Autopilot Discount” depending on the driving mode and capabilities of the car. This means that the insurance will get cheaper soon after improvements to Autopilot are made.

- Right now, Tesla’s are quite expensive to insure, which puts pressure on sales. Tesla can opt to make money on vehicles, software and service instead of maximizing insurance profit margin.

- Better leveraging the data it already collects about incidents, e.g. by incorporating it into the machine learning strategy.

On social media, people are already sharing that they switched to Tesla insurance and saved up to 50% on their premiums even though 20% seems to be more common.

Tesla is know to adjusts its offering as it learns or as it develops new features. The following are interesting options Tesla can and might pursue:

- Competitive insurance rates because of direct knowledge of risk profiles of drivers based on information obtained from the connected vehicles.

- Cost reductions and improved customer service experience are expected because Tesla can leverage the suite of camera’s and sensor suite to handle insurance claims quickly and easily. Getting recordings from vehicles is easy with the 4G/LTE connection that’s always present. Understanding who’s liable is easier when you have footage from multiple angles and clocks that are synchronized with atomic clocks.

- Very specific feedback can be given to help a driver drive more safely and perhaps influence the premium.

- Fast track repairs for Tesla Insurance customers by integrating with planning software of authorized body shops, reading real-time telematics from vehicles.

- They could introduce delightful features like configuring a loaner Tesla to behave like your existing one by uploading your settings and allowing your existing keyfob/card/phone to open it.

- Tesla learns about the average occupancy of a vehicle through seat and seatbelt sensors and can adjust its risk profiles (occupant insurance factors in with the rates).

While Tesla bears claim going into insurance is a distraction, it may actually simply be a requirement to fully offer autonomous ride-hailing fleet. It’s pretty standard to insuring a car if it’s driven by a single family or by employees of a company. But what if your car is part of the Tesla Network of self-driving vehicles? The locus of control over the vehicle can change between several actors, even in an instant. The FSD-computer could be driving autonomously, an occupant can starts to actively drive or a tele-operator can take control of the vehicle. Responsibility and liability changes within a split second. Also, the occupant may also be different for each ride. For Tesla to gain control over the insurance processes and terms by effectively becoming the insurer doesn’t seem like a distraction to me. Also, in the US alone around $250 billion in auto insurance premiums are paid. Berkshire Hathaway has a 13% market share in auto insurance and spends 6.8% of its revenue on advertising. Tesla is likely to have a lower cost footprint because it isn’t advertising and has no plans to do so. Tesla will have a direct financial benefit to improving active safety features in its Autopilot technology (increased insurance margins) in addition to secondary effects (e.g. top reputation and getting 5 star ratings). Based on “Now you Know” napkin math I estimate gross revenue to reach up to $1 billion in annual revenue within years. This assumes Tesla’s growth trajectory continues, that 50% of Tesla owners would be insured through Tesla and that Tesla doesn’t continue to improve vehicle safety, which patent filing indicates it’s still investing in.

Other ways to reduce cost of insurance unique to Tesla (at this point in time) are:

- Sentry Mode is reducing claim rates by deterring vandals or allowing them to be identified and tracked down

- Version 9 of the software introduced dashcam feature that allows you to use 3 or 4 of the existing camera’s and continuously record while driving. This allows tracking the perpetrator in a hit-and-run situation.

- When enabled, pin-to-drive requires you to not just have a key, but also know a code to drive.

Even though Tesla’s are valuable vehicles, sentry mode, pin-to-drive and the ability to track a vehicle when stolen are partially responsible for the unsually low theft rates. Tesla’s in the US are 90% less likely to be stolen compared to the average vehicle.

Maybe the real reason why Warren Buffett warned Elon Musk not to enter the insurance industry is that Elon’s has a track record of disrupting industries such as banking/payments (PayPal), energy and automotive (Tesla), space launches and satellite internet (SpaceX) in addition to energy and automotive. And if would apply Buffet’s own advice on value investing in companies with a moat: Tesla has a triple moat: information arbitrage because of a data-processing advantage, more control over processes through vertical integration and a strong brand.

Part 4: Other energy products

Tesla isn’t just an automaker. It now produces significant amounts of battery packs and is achieving economies of scale both in R&D and manufacturing. For Solar Roofs and Powerwalls, it has retail synergies as well. A Superchargers’ power converters and grid-controllers require the same engineering and manufacturing skillsets.

The costs of batteries

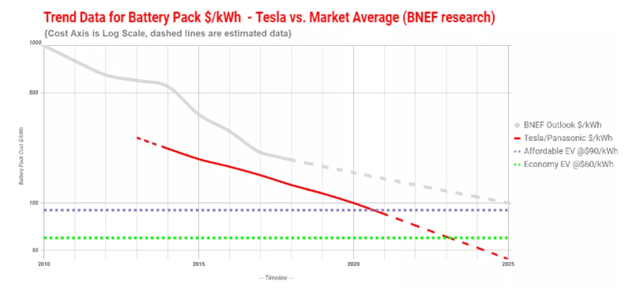

The cost of Lithium-ion batteries dropped 14% over a 15 years period. Between 2010-2016 the cost decline curve accelerated to 20% YoY (Clean Disruption).

Lithium-ion batteries are now reaching a cost point where a new market is being created for stationary storage that didn’t really exist yet. Yet, while the costs have come down so much, there is no apparent reason for this cost curve to suddenly stagnate, such as mineral shortages. People assume that exponentially improving technology doubles every x years, but time is not the correct horizontal axis to plot such an exponential curve on, cumulative production volume is. This pattern is described by Wright’s law and the expansion into new markets like stationary storage only improves the learning rate, which lowers costs while increasing performance, longevity and volumetric/gravimetric energy density.

The previous graph implies that if Tesla increases its production rate in terms of kWh, it can improve costs per kWh logarithmically. This would mean that the dashed red line below remains straight on a logarithmic plot:

This means that battery cost reductions will continue to happen and faster for Tesla than others because it produces as many EV battery-capacity as the rest of the world combined.

Elon has stated that by the end of 2018 Tesla will likely be at $100 per kWh, which would today put them about 3 years ahead of the competition for cells already integrated in a pack.

Renewable energy and batteries go hand in hand

When deploying energy storage in a grid-tied setup, batteries go hand in hand with the intermittency of renewable energy production such as solar and wind. Residential and businesses are a large market (e.g. a 2017 study by NREL reveals that 5 million US businesses can achieve cost savings by deploying batteries to avoid peak charges). This market will expand with the cost decline.

There’s also the utility level that is being disrupted. It even go as far as to reduce the need for “peaker” power plants that use gas or coal, and this is a viable because the cost of storage and renewable power production are declining at the same time. Fossil fuels could become more expensive due to emissions regulation or by becoming increasingly difficulty to extract, so by having crossed grid parity in more and more places, it’s game over for coal and gas.

In Hornsdale, Australia $66 million dollar of Tesla’s utility products were deployed, also within 3 months of receiving the contract. The utility thinks it will earn back 33% in its first year of operation and 18% of its investment per calendar year, even though it uses only 30 of its 100 MW capacity (source). Such a return on invested capital is remarkable and explains Tesla’s increasing energy sales (YoY growth was 104% on June 30, 2019). The acquisition of Solar City has been followed with a decline in solar revenues, but the growth of the energy storage products has kept the non-automotive revenues stable. In Q3 2019, the the highly anticipated Tesla Solar Roof has launched and is ramping up to 1000 roofs per week and aiming for 10 to 20 times more roofs over time. Besides pure economics, incidents and planned blackouts like we’re seeing in California, can increase the demand for domestic and utility level energy storage. A major utility in Southern California responded to a methane leak causing by adopting Powerpacks. Tesla can deploy such systems quickly, this particular system was completed by Tesla in just 88 days.

Being diversified even across entirely different industries is as helpful to mitigating risk as it is unique. While some automakers get media-attention with second-use batteries used for stationary purposes, they don’t install capacity in the order of half a Gigawatt-hour because they each sell enough EVs for that many packs to be returned. Mercedes tried to challenge Tesla but decided to quit the residential market claiming there is no demand for batteries that were initially designed for cars. The big difference between the Mercedes and Tesla energy storage products is, however, that Tesla’s product uses new batteries with a chemistry that is optimized for stationary storage instead of usage in vehicles.

The intermittency also relates to a trend towards a more decentralized and bi-directional power grid, which were not requirements that utilities had originally planned for. Domestic batteries like Tesla’s PowerWall fit well into this scenario. It’s possible for home-owners to buy it and save money, or could be applied in a configuration controlled by the utility as a virtual power buffer.

Potential future markets for batteries: aerospace and boring transportation pods

The gravimetric density of batteries is also being improved, meaning that you get more storage capacity for the same weight. While electric aeroplanes have been possible for a while and are cost effective, the range effectively limits the adoption. There’s no reason why Tesla can’t become at least a supplier to this industry or even play an even bigger role. I’m not counting on this specific example creating earnings any time soon, but I don’t the aerospace industry is immune to the trend in electrification. Moreover, it’s a polluting industry that will sooner or later feel the (regulatory) pressure to become cleaner. Airbus already has electrification on its roadmap and their next jet might be a hybrid. Also, there isn’t a single airline that doesn’t want to save money given that margins are under pressure, so once electrified flight is competitive, it’s almost certain to see significant adoption.

The Boring Company, founded by Elon Musk, intends to move cargo and people through tunnels dug by battery-powered drilling machines. The plan is to transport cargo and people through a network of tunnels in autonomous pods. Being battery powered greatly reduces the need for ventilation, increases flexibility and lowers cost. While all but one of the projects by the Boring Company are still in the permitting stage, there’s no lack of ambition to disrupt transportation by making tunnel digging vastly cheaper and automatically routing traffic through such networks.

Part 5: Vertical integration

One common theme of the previous sections is that there’s a lot of vertical integration, but this deserves a section of itself because there’s so much of that going on. A non exhaustive list:

- Software is at the core of the products and is a core competency at Tesla (instead of being outsourced and fragmented) which leads to a better experience and a constant stream of improvements to microcontrollers in pretty much every major component of the car, after being delivered.

- Supplying their automotive and energy products with batteries from their Nevada Gigafactory plant that outputs as much EV-battery capacity as the rest of the world instead of having to compete with other automakers for battery supply from LG or Samsung.

- Their battery pack design is tightly integrated with the rest of the vehicle design including thermal management of battery, motor and cabin air conditioning leading to vehicle safety, reduced battery degradation and award-winning energy efficiency.

- Their own highly efficient and compact motors and inverter electronics results in weight savings, superior performance, range and longevity.

- Makes things happen across different departments. Integrated approach thermal management that includes cabin climate control, electronics cooling, drive unit cooling and battery cooling and heating. This unusual in the automotive industry, yet very elegant and effective (see these statements by Sandy Munro).

- The supercharging network and in-vehicle software (en-route battery preconditioning) allows for a 50% charge during a 12 minute charging stop.

- Offering insurance with the promise of cheaper rates and a better overall experience.

- Owning the Tesla stores and Service Centers instead of relying on dealerships that are reluctant to sell electric vehicles.

- A Tesla can self-diagnose, report the result and even pre-order a part for itself to be shipped to a the nearest Service Center. It will then help you schedule a service visit through the app without having to give your own explanation the issue.

- Tesla vehicles, Powerwalls and solar are all bundled in the same smartphone app, since each of them interact anyway on your utility connection.

- Tesla designed its own sensor suite, created a Full Self Driving-computer from scratch tailored to their use-case, developing its own highly realistic simulation engine, creating a fleet-data collection and developing AI training programs including proprietary tools used in-house to efficiently label objects and events in the training data. Reduced reliance and integration seems to speed up the rate at which they can improve Autopilot features.

- Tesla has a higher upper ceiling for Autopilot safety since Hardware 2, released in 2016. Radar based Traffic Aware Cruise Control (TACC) and camera based Lane Keeping systems have existed for a while in cars, however most manufacturers rely on completely separate companies for each sensor e.g. Bosch for radar and MobileEye for vision processing. Because of this lack of integration, accidents happen that could be prevented with better sensor fusion. For instance, a radar can ‘see’ more than one car ahead even if the car ahead is visually obscuring the next one. Tesla’s have already prevent collisions in this way.

- Tesla’s were already fully self driving on US highways since 2018 and have collectively driven 1 billion miles using this feature. They drive and navigate from highway on-ramp, through interchanges, while overtaking slower traffic and automatically taking the right exit. While the driver is still responsible for monitoring and confirming actions, it’s convenient and increasingly reliable. This is made possible because Tesla developed their own navigation and routing engine which uses information such as which lane you are in which Autopilot determines based on camera input. Never again miss an exit, never again deal with outdated maps (these are updated over-the-air).

- Tesla develops their in-house special purpose computing hardware and software that’s dedicated for training neural networks (currently using special purpose GPU clusters, but developing Dojo). This allows more efficient training, faster iteration and overall in increased speed and quality of the resulting neural networks that are used for driving automation across the Tesla fleet.

- You don’t need to plan charging stops for long journeys, Tesla’s do this automatically for you. It’s able to accurately predict your battery’s state along a journey, its navigation is traffic aware and even factors in elevation changes, wind speeds and real-time occupancy of Supercharger stalls. TomTom received an award for adding some form of “charger and battery awareness” in 2019, however this is 4 years after Tesla started doing this.

- To keep Supercharging stalls available to those who need a charge, Tesla pushes notifications to a user’s phone when they can continue on their journey and charges a customer idle-fees directly if it stays there for more than 5 minutes after a warning.

- Connectivity: you get a push message if you car alarm goes off, later you can hand in the footage from 3 of the 8 camera’s to track down the perpetuator or for an insurance claim.

- Your phone with Tesla app installed replaces the need for a vehicle key (Model 3).

- Tesla switched to manufacturing its own seats from using outsourced seats that were not satisfactory.

- In-house developed vehicle dynamics controller to improve stability and handing. By adjusting the power distribution between front and rear motor at a millisecond rate based on steering and throttle inputs, it gives amateur drivers track-worthy racing capabilities.

- The Maxwell acquisition further increasing the lead in battery density, cost and longevity and level of integration.

Part 6: Why Tesla is set up for continued growth

Tesla started out with very expensive cars and introduced increasingly affordable models. From the beginning, the plan was to successively reach a larger audience with more affordable models.

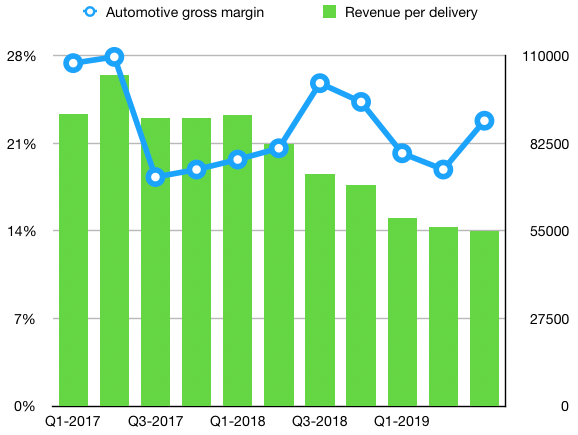

It’s possible to maintain automotive industry gross margins of 15-30% while simultaneously reducing the ASP, but this required scale and a lot of investment in addition to ingenuity and perseverance. Obviously, industry level margins are only good if you can eventually achieve net profitability through scale, allowing you to recoup overhead costs and pay all financing costs. The fact that many technologies including batteries and electric drivetrains are years ahead of the competition, they can continue to reduce prices and reach an even larger market.

If production efficiency wouldn’t improve, the gross margins would have to decline along with the decline in revenue per vehicle, but this isn’t the case: In Q3 of 2019 the gross margin was 22,8%, up from 18,9%. Efficiency gains were achieve in Q2 as well as Q3, but in Q2 the ASP was lower due to a lower mix (fewer Model S/X because of the Osborne effect). In 2018 and 2019 Tesla ramped up Model 3 production and introduced lower cost version of the model 3 and expanded into new geographic regions. The latter caused what was causing “delivery hell”, visible in Q1 2019 delivery numbers.

Is there room for margins to improve, or for Tesla to continue to lower its ASP? Unless disaster strikes, margin improvements are part of the battery game and launching new products. Also, the increasingly large fraction of software in products has the ability to improve margins per incremental unit produce, which makes scale important, because high quality software is expensive to develop. Most Full Self Driving revenue is not part of the ASP yet. Introducing it will turn deferred revenues into realized revenues.

Also, the Gigafactory in Shanghai (GF3) will have lower labor costs (OPEX) and lower Capital Expenditure (CAPEX). Tesla’s CFO thinks CAPEX per unit produced in Shanghai will be half that of the Fremont factory). Robbe Delaet quantified this in his article here. GF3 is now operational and set to start volume production at the end of 2019. This is unprecedented, since they broke ground on January 7, 2019.

There is a macro-event that at some point needs to happen. Right now fossil fuels are being subsidized with $370 billion a year. According to calculations by the International Institute for Sustainable Development (see this Guardian article), if 10 to 30% of this money is redirected it could finance the entire transition towards clean energy. It might be my wishful thinking, but I think it’s likely that these subsidies are reduced, because the goals from Paris agreements are not possible without drastic measures such as these. More importantly: redirecting subsidies is budget neutral and is a way to generate jobs in industries that have an actual future (unlike artificially supporting coal jobs). The cost of renewables is dropping fast, and oil & gas aren’t likely to follow. In most countries (see page 9 of this report), unsubsidized utility scale solar and wind both are already cheaper than gas peakers in terms of cost of energy (LCOE). The report also mentions “without storage, however, these resources lack the dispatch characteristics of such conventional generation technologies”. Tesla is well positioned for a significant growth opportunity. Electric Vehicles can often be charged at 23 out of 24 hours of the day, when they’re parked. This flexibility can be used to charge only when renewables energy is in excess, so the LCOE of solar/wind are the effective costs. Renewable can be sourced from quite far away, because transmission losses are usually in the 8 to 15% range. For instance, the average distribution losses in the US power grid are just 5%.

Conclusion

Tesla is successfully disrupting industries and is positioned to leverage its energy technologies, its brand and an increasing array of products to become a financially sustainable company. Its culture, attitude and ability to attract top talent allow it to (often) deliver the on ambitious targets. While not always on time, this has resulted in years of lead compared to legacy automakers. Where most of the auto industry is facing inertial and large emissions fines (headwind), Tesla is getting paid billions of dollars (tailwind) to pool their fleet with other automotive players. Today, the automotive incumbents are unable to make electric vehicle profitably nor at scale nor do the meet the performance and range of even a used 2013 Tesla Model S. The Tesla brand is so strong that have never relied on advertising to increase sales. They’re the only automaker that’s so far has been allowed to build a wholly owned factory in China. Tesla doesn’t rely on outside manufacturers to the extent that traditional automakers do, which is something people are starting to notice. Vertical integration allows for creation of more compelling, elegant and better performing products with healthy gross margins.

While Tesla (as a company) has and will continue to have a “bumby ride”, it’s definitely heading towards sustainability.

Recente reacties